Veteran African economist Yacouba Fassassi strongly advocates a break-away from the CFA franc

BY ALAN GREEN

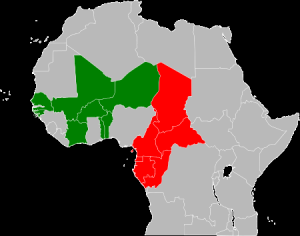

“There will be no more government, no more democracy. Instead, there will be anarchy and simply every man for himself,” veteran African economist Yacouba Fassassi warns, if the 12 former African French colonies, Equatorial Guinea (a former Spanish colony), and Guinea-Bissau (a former Portuguese colony) that have the CFA franc in common don’t break away from this currency that is pegged to the euro, with one euro being the equivalent of 655.957 CFA francs.

The CFA zone countries have a combined population of 147.5 million people, according to 2013 census figures, and a combined GDP of US$166.6 billion, as of 2012. Says Dr. Fassassi: “I want to stress that it is not a mere threat, or, as in bullfighting, a red cloth thrown in the face of our leaders to scare them. No, it’s the reality that is emerging and that is inevitable if the French-speaking countries do not break quickly and intelligently with the CFA franc system and engage resolutely on the path to a regional monetary integration with a single currency freely thought, honestly deliberate, and voluntarily assumed with full responsibility.” He stresses: “In other words, the choice is between monetary and federal integration or death of our CFA franc zone states.”

DR. FASSASSI’S FRESH LOOK AT AN OLD ECONOMIC ANOMALY

While the debate about the CFA franc is not new, Dr. Fassassi, who has authored several books, recently took the debate to a new level with fresh ideas and this dire warning in his recently-published book in French, “LE FRANC CFA ou la monnaie des pays PMA (les pays Pas Moyen d’Avancer),” [unofficially, THE CFA FRANC or the Currency of Countries no way to move Forward or Ahead.] As a young researcher at the University of Paris IX-Dauphine, France, where he earned his first Ph.D. in economics in 1978, Dr. Fassassi says he was lucky to be part of different groups of study and research alongside French, British and German economists writing economic reports that formed “the intellectual architecture” for the birth of the single European currency, the euro.

While the debate about the CFA franc is not new, Dr. Fassassi, who has authored several books, recently took the debate to a new level with fresh ideas and this dire warning in his recently-published book in French, “LE FRANC CFA ou la monnaie des pays PMA (les pays Pas Moyen d’Avancer),” [unofficially, THE CFA FRANC or the Currency of Countries no way to move Forward or Ahead.] As a young researcher at the University of Paris IX-Dauphine, France, where he earned his first Ph.D. in economics in 1978, Dr. Fassassi says he was lucky to be part of different groups of study and research alongside French, British and German economists writing economic reports that formed “the intellectual architecture” for the birth of the single European currency, the euro.

Dr. Fassassi has since been credited with real-life achievements in African economic development, both at the international level and in his home country Benin.

Dr. Fassassi, a veteran economist who earned his first Ph.D. from the University of Paris IX-Dauphine, France (1978) and his second one from The George Washington University, in Washington, D.C. (1987), was a special advisor to two Benin presidents: Nicéphore Soglo and Mathieu Kérékou (1991 to 2006), while serving as the chairman of the board of economic advisors under both heads of state. He previously held the position of senior economist at the International Monetary Fund in Washington prior to being called upon by President Soglo to join his cabinet in Benin in 1990, at the time when Benin engaged in a ground-breaking democratization process and sweeping economic reform that quickly spread to other African countries. Several economists that Dr. Fassassi brought along included a young economist named Yayi Boni who, years after working under Dr. Fassassi, became the president of Benin in 2006.

THE CFA FRANC, A COLONIAL RELIC

TO BE RETIRED

The French colonial administration created the CFA franc, which stands for Franc des Colonies Françaises d’Afrique (franc of the French colonies of Africa) on December 25, 1945 and imposed it on its twelve colonies the same way it imposed the French language on them to keep them together in an effort to smooth out the colonization and assimilation process. Dr. Fassassi states in his new book that the CFA franc is now “a colonial relic that must be retired, and the former French colonies should be left alone and be able to sing ‘Free at Last, Free at last, thank God Almighty we are free at last.’”

The European countries of the euro zone are expected to constitute ultimately an optimal currency area with the fulfillment of the convergence criteria and fiscal federalism that can raise the level of economic and social development of the less developed countries of the area, which explains the massive funding available to countries such as Greece and other less developed countries of the zone. But, says Dr. Fassassi, African countries, with their currency irreversibly pegged to the euro, “are registered in the second division of the euro zone. As such, they cannot receive assistance from the European Central Bank. Rather, they are what we can call ‘willing victims’ of the euro.” The author then wonders: “If Europe has managed to create its single currency to make the most of the wide saving benefits of any regional economic and monetary integration, why can’t the French-Speaking countries of West Africa, which share a common history, a common culture and a common civilization, in particular the ECOWAS (Economic Community of West African States) countries, have their own single currency?”

Dr. Fassassi stresses that “the euro to which the CFA franc is pegged is not the currency of foreign trade of our countries. In fact, for their trade, the Nigerian currency, the Naira, is much more relevant for those French-speaking countries than the CFA franc or euro.”

The veteran economist states emphatically that “the CFA franc has become an operating system to deprive the poorest countries and the neediest of the world of their hard-earned wealth, a systematic transfer system to the French Treasury of foreign currencies (dollar, euro, yen …) hard-earned from commodities and services exports of our countries. Through the system of the CFA franc, African countries enrich France by depleting and impoverishing themselves.”

Dr. Fassassi is advocating a break-away from the euro, but by no means a break-away from France. Instead, he says, “we should bring France to accompany the birth of the single currency of ECOWAS.”

In fact, some of the harshest critics of the one-sided marriage between the euro and the CFA franc are the French leaders themselves. In his book, Dr. Fassassi quotes former French president Jacques Chirac as saying as recently as in 2012: “You forget one thing: it is that part of the money that is in our wallet comes precisely from exploitation for centuries of Africa … So you need a little bit of common sense and justice to give back to Africans what has been taken from them as much as it is necessary if we are to avoid the worst convulsions or difficulties with the political consequences that it entails in the near future.”

The author also quotes former Senegalese president Abdoulaye Wade as urging “France to return to the African countries of the franc zone the money that France takes everyday from them.” The former Senegalese head of state who is known for his “colorful language,” reportedly described the CFA franc zone as “a zone for profits export,” adding: “This is an area in which those who make money in the morning export it at night.” But Dr. Fassissi says the former Senegalese is not an exception. “I must emphasize here that our Heads of State have become aware that they will never succeed in taking their people out of ambient misery and abject poverty because of the CFA franc, despite the laudable efforts that most of them do every day to build modern nations,” the author states.

The author smells trouble in the near future, saying that “the disappearance of our French African states is no longer a theoretical hypothesis. For now, the disasters of the CFA franc pegged to the euro are more visible through the increase of the shadow and underground economy. There will be at the end of this process a suffocation of the state.”

Dr. Fassassi foresees a new devaluation of the CFA franc down the road. (The last one dates back to January 1994 when the currency lost 50% of its value to the French franc.) The next one, he fears, might equate one euro to 15,000 francs (against the current ratio of one euro to 655.957 CFA francs.) The author sounds the alarm: “This will be the great impasse, the deadlock, a real economic and social Tsunami that will sweep his way and destroy any political system and break the backbone of African governments in the franc zone. It is no longer a hypothesis of the economists, or a mere forecasting, a red rag stirred in front of our Heads of State. It is a certainty rooted in the power of Economics.”

AFRICAN MONETARY INTEGRATION, A MUST

To avoid this collective shipwreck of African economies in the franc zone that Dr. Fassassi fears could happen over the next ten years, there is only one solution, he says: The economic and monetary regional integration with a single currency. “A regional and monetary integration freely thought, ardently desired, and wisely assumed.”

Monetary integration is a global movement, Dr. Fassassi states, adding that Europe has understood this, America has understood it, Asia is preparing for it, and in West Africa, Nigeria, Ghana and other countries outside the CFA franc zone have already established the second monetary zone of ECOWAS called WAMZ (West African Monetary Zone). Therefore, the author adds, if the CFA franc countries are slow to join this monetary integration movement, this our country Benin is likely to sink further in the already heavy impoverishment. However, the break-away from the CFA franc system, Dr. Fassassi cautions, should not be understood as a monetary adventurism where each of the franc zone countries would decide to issue its own currency. It would be suicidal for the economy of each and all, he warns.

Furthermore, and finally, as if the misfortune of the CFA franc system were not enough for Benin especially, it is the real economy that will collapse in the short term with the construction of the most important deep-water port in the whole of Africa by Nigeria at the border it shares with Benin, this economist fears. Because the Port of Cotonou—the main source of wealth in Benin—will become less competitive with an overvalued CFA franc, and, therefore, less relevant.

The veteran economist’s prescription is crystal-clear: Regional integration with a single currency in the framework of the Economic Community of West Africa States. He pleads: “So let’s break this neo-colonial policy which serves the colonial master’s interests, and let’s embrace a new governance, a regional governance that will unequivocally serve the best interests of the people of Benin.”

“LE FRANC CFA ou la monnaie des pays PMA (les pays Pas Moyen d’Avancer) is listed on http://www.amazon.com/Yacouba-Fassassi/e/B00HP23260